Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

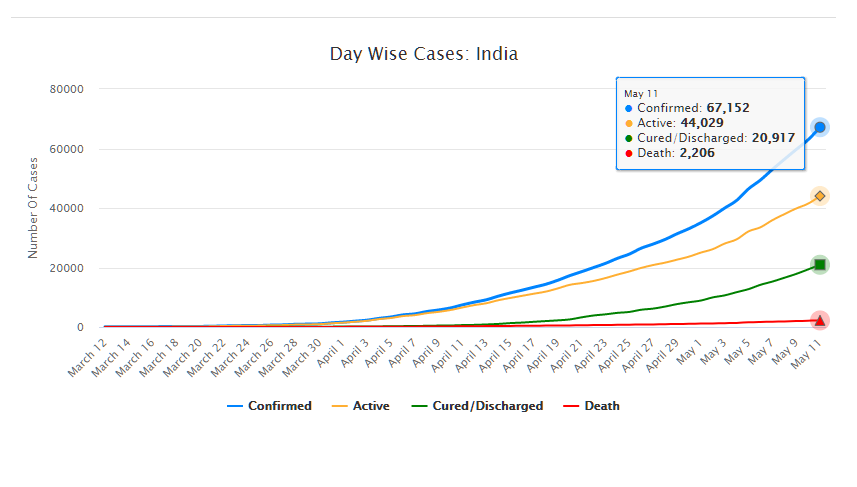

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

Over the last two months, the centre and over 15 states have passed laws to levy the Goods and Services Tax (GST). Under these laws, tax rates recommended by the GST Council will be notified by the government. The Council met in Srinagar last week to approve rates for various items. Following this decision, the government has indicated that it may invoke provisions under the GST laws to monitor prices of goods and services.[1] This will be done by setting up an anti-profiteering authority to ensure that reduction in tax rates under GST results in a fall in prices of goods and services. In this context, we look at the rates approved by the GST Council, and the role of the proposed authority to ensure that prices of various items do not increase under GST.

Q. What are the tax rates that have been approved by the Council?

The Council has classified various items under five different tax rates: (i) 5%, (ii) 12%, (iii) 18%, (iv) 28%, and (v) 28% with an additional GST compensation cess (see Table 1).[2],[3],[4] While tax rates for most of the goods and services have been approved by the Council, rates for some remaining items such as biscuits, textiles, footwear, and precious metals are expected to be decided in its next meeting on June 3, 2017.

Table 1: Tax rates for goods and services as approved by the GST Council

| 5% | 12% | 18% | 28% | 28% + Cess | |

|---|---|---|---|---|---|

| Goods |

|

|

|

|

|

| Services |

|

|

|

|

Source: GST Council Press Release, Central Board for Excise and Customs.

Q. Will GST apply on all goods and services?

No, certain items such as alcohol for human consumption, and petroleum products such as petrol, diesel and natural gas will be exempt under GST. In addition to these, the GST Council has also classified certain items under the 0% tax rate, implying that GST will not be levied on them. This list includes items of daily use such as wheat, rice, milk, eggs, fresh vegetables, meat and fish. Some services such as education and healthcare will also be exempt under GST.

Q. How will GST impact prices of goods and services?

GST subsumes various indirect taxes and seeks to reduce cascading of taxes (tax on tax). With greater efficiency in the supply of products, enhanced flow of tax credits, removal of border check posts, and changes in tax rates, prices of goods and services may come down.[5],[6],[7] Mr Arun Jaitley recently stated that the Council has classified several items under lower tax rates, when compared to the current system.[8]

However, since some tax rates such as VAT currently vary across states, the real impact of GST rates on prices may become clear only after its roll-out. For example, at present VAT rates on smart phones range between 5-15% across states. Under GST they will be taxed at 12%.[9] As a result while phones may become marginally cheaper in some states, their prices may go up in some others.

Q. What happens if tax rates come down but companies don’t reduce prices?

Few people such as the Union Revenue Secretary and Finance Ministers of Kerala and Jammu and Kashmir have expressed concerns that companies may not lower their prices despite a fall in tax rates, in order to increase their profits. The Revenue Secretary also stated that the government had received reports of few businesses increasing their product prices in anticipation of GST.[10]

To take care of such cases, the GST laws contain a provision which allows the centre to constitute an anti-profiteering authority. The authority will ensure that a reduction in tax rates under GST is passed on to the consumers. Specific powers and functions of the authority will be specified by the GST Council.[11],[12]

Q. Are there any existing mechanisms to regulate pricing of products?

Various laws have been enacted over the years to control the pricing of essential items, or check for unfair market practices. For example, the Essential Commodities Act, 1955 controls the price of certain necessary items such as medicines, food items and fertilisers.[13]

Parliament has also created statutory authorities like the Competition Commission of India to check against unfair trade practices such as cartelisation by businesses to inflate prices of goods. Regulators, such as the National Pharmaceutical Pricing Authority, are also responsible for regulating prices for items in their sectors.

Q. Could there be some challenges in implementing this mechanism?

To fulfil its mandate, the anti-profiteering authority could get involved in determining prices of various items. This may even require going through the balance sheets and finances of various companies. Some argue that this is against the idea of prices being determined by market forces of demand and supply.[14]

Another aspect to consider here is that the price of items is dependent on a combination of factors, in addition to applicable taxes. These include the cost of raw material, technology used by businesses, distribution channels, or competition in the market.

Imagine a case where the GST rate on a category of cars has come down from the current levels, but rising global prices of raw material such as steel have forced a manufacturer to increase prices. Given the mandate of the authority to ensure passing of lower tax rates to consumers, will it also consider the impact of rising input costs deciding the price of an item? Since factor costs keep fluctuating, in some cases the authority may find it difficult to evaluate the pricing decision of a business.

Q. Have other countries tried to introduce similar anti-profiteering frameworks?

Some countries such as Malaysia have in the past introduced laws to check if companies were making unreasonably high profits after the roll-out of GST.[15] While the law was supposed to remain in force for a limited period, the deadline has been extended a few times. In Australia, during the roll out of GST in the early 2000s, an existing authority was entrusted with the role of taking action against businesses that unreasonably increased prices.[16] The authority also put in place a strategy to raise consumer awareness about the available recourse in cases of price exploitation.

With rates for various items being approved, and the government considering a mechanism to ensure that any inflationary impact is minimised, the focus now shifts to the implementation of GST. This includes operationalisation of the GST Network, and notification of rules relating to registration under GST and payment of tax. The weeks ahead will be crucial for the authorities and various taxpayers in the country to ensure that GST is successfully rolled out from July 1, 2017.

[1] After fixing rates, GST Council to now focus on price behaviour of companies, The Hindustan Times, Ma 22, 2017, http://www.hindustantimes.com/business-news/after-fixing-rates-gst-council-to-now-focus-on-price-behaviour-of-companies/story-fRsAFsfEofPxMe2IXnXIMN.html.

[2] GST Rate Schedule for Goods, Central Board of Excise and Customs, GST Council, May 18, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/chapter-wise-rate-wise-gst-schedule-18.05.2017.pdf.

[3] GST Compensation Cess Rates for different supplies, GST Council, Central Board of Excise and Customs, May 18, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/gst-compensation-cess-rates-18.05.2017.pdf.

[4] Schedule of GST Rates for Services as approved by GST Council, GST Council, Central Board of Excise and Customs, May 19, 2017, http://www.cbec.gov.in/resources//htdocs-cbec/gst/Schedule%20of%20GST%20rates%20for%20services.pdf.

[5] GST rate impact: Here’s how the new tax can carry a greater punch, The Financial Express, May 24, 2017, http://www.financialexpress.com/economy/gst-rate-impact-heres-how-the-new-tax-can-carry-a-greater-punch/682762/.

[6] “So far, the GST Council has got it right”, The Hindu Business Line, May 22, 2017, http://www.thehindubusinessline.com/opinion/the-gst-council-has-got-it-right/article9709906.ece.

[7] “GST to cut inflation by 2%, create buoyancy in economy: Hasmukh Adhia”, The Times of India, May 21, 2017, http://timesofindia.indiatimes.com/business/india-business/gst-to-cut-inflation-by-2-create-buoyancy-in-economy-hasmukh-adhia/articleshow/58772448.cms.

[8] GST rate: New tax to reduce prices of most goods, from milk, coal to FMCG goods, The Financial Express, May 19, 2017, http://www.financialexpress.com/economy/gst-rate-new-tax-to-reduce-prices-of-most-goods-from-milk-coal-to-fmcg-goods/675722/.

[9] “Goods and Services Tax (GST) will lead to lower tax burden in several commodities including packaged cement, Medicaments, Smart phones, and medical devices, including surgical instruments”, Press Information Bureau, Ministry of Finance, May 23, 2017.

[10] “GST Townhall: Main concern is consumer education, says Adhia”, Live Mint, May 24, 2017.

[11] The Central Goods and Services Tax Act, 2017, http://www.prsindia.org/uploads/media/GST,%202017/Central%20GST%20Act,%202017.pdf.

[12] Rajasthan Goods and Services Tax Bill, 2017; Madhya Pradesh Goods and Services Tax Bill, 2017; Uttar Pradesh Goods and Services Tax Bill, 2017; Maharashtra Goods and Services Tax Bill, 2017.

[13] The Essential Commodities Act, 1955.

[14] “GST rollout: Anti-profiteering law could be the new face of tax terror”, The Financial Express, May 23, 2017, http://www.financialexpress.com/opinion/gst-rollout-anti-profiteering-law-could-be-the-new-face-of-tax-terror/680850/.

[15] Price Control Anti-Profiteering Act 2011, Malaysia.

[16] ACCC oversight of pricing responses to the introduction of the new tax system, Australia Competition and Consumer Commission, January 2003, https://www.accc.gov.au/system/files/GST%20final%20report.pdf.