Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

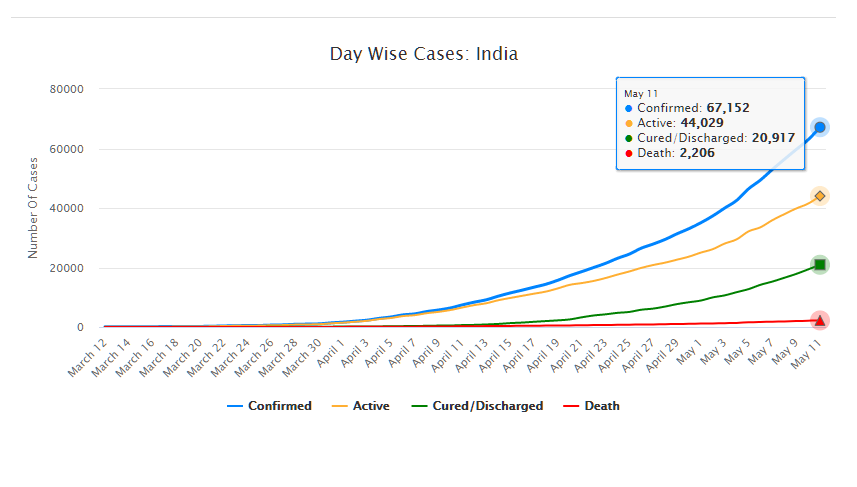

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

At noon today, the Finance Minister introduced a Bill in Parliament to address the issue of delayed debt recovery. The Bill amends four laws including the SARFAESI Act and the DRT Act, which are primarily used for recovery of outstanding loans. In this context, we examine the rise in NPAs in India and ways in which this may be dealt with.

I. An overview of Non-Performing Assets in India

Banks give loans and advances to borrowers which may be categorised as: (i) standard asset (any loan which has not defaulted in repayment) or (ii) non-performing asset (NPA), based on their performance. NPAs are loans and advances given by banks, on which the borrower has ceased to pay interest and principal repayments.  In recent years, the gross NPAs of banks have increased from 2.3% of total loans in 2008 to 4.3% in 2015 (see Figure 1 alongside*). The increase in NPAs may be due to various reasons, including slow growth in domestic market and drop in prices of commodities in the global markets. In addition, exports of products such as steel, textiles, leather and gems have slowed down.[i] The increase in NPAs affects the credit market in the country. This is due to the impact that non-repayment of loans has on the cash flow of banks and the availability of funds with them.[ii] Additionally, a rising trend in NPAs may also make banks unwilling to lend. This could be because there are lesser chances of debt recovery due to prevailing market conditions.[iii] For example, banks may be unwilling to lend to the steel sector if companies in this sector are making losses and defaulting on current loans. There are various legislative mechanisms available with banks for debt recovery. These include: (i) Recovery of Debt Due to Banks and Financial Institutions Act, 1993 (DRT Act) and (ii) Securitisation and Reconstruction of Financial Assets and Security Interest Act, 2002 (SARFAESI Act). The Debt Recovery Tribunals established under DRT Act allow banks to recover outstanding loans. The SARFAESI Act allows a secured creditor to enforce his security interest without the intervention of courts or tribunals. In addition to these, there are voluntary mechanisms such as Corporate Debt Restructuring and Strategic Debt Restructuring, which These mechanisms allow banks to collectively restructure debt of borrowers (which includes changing repayment schedule of loans) and take over the management of a company.

In recent years, the gross NPAs of banks have increased from 2.3% of total loans in 2008 to 4.3% in 2015 (see Figure 1 alongside*). The increase in NPAs may be due to various reasons, including slow growth in domestic market and drop in prices of commodities in the global markets. In addition, exports of products such as steel, textiles, leather and gems have slowed down.[i] The increase in NPAs affects the credit market in the country. This is due to the impact that non-repayment of loans has on the cash flow of banks and the availability of funds with them.[ii] Additionally, a rising trend in NPAs may also make banks unwilling to lend. This could be because there are lesser chances of debt recovery due to prevailing market conditions.[iii] For example, banks may be unwilling to lend to the steel sector if companies in this sector are making losses and defaulting on current loans. There are various legislative mechanisms available with banks for debt recovery. These include: (i) Recovery of Debt Due to Banks and Financial Institutions Act, 1993 (DRT Act) and (ii) Securitisation and Reconstruction of Financial Assets and Security Interest Act, 2002 (SARFAESI Act). The Debt Recovery Tribunals established under DRT Act allow banks to recover outstanding loans. The SARFAESI Act allows a secured creditor to enforce his security interest without the intervention of courts or tribunals. In addition to these, there are voluntary mechanisms such as Corporate Debt Restructuring and Strategic Debt Restructuring, which These mechanisms allow banks to collectively restructure debt of borrowers (which includes changing repayment schedule of loans) and take over the management of a company.

II. Challenges and recommendations for reform

In recent years, several committees have given recommendations on NPAs. We discuss these below.

Action against defaulters: Wilful default refers to a situation where a borrower defaults on the repayment of a loan, despite having adequate resources. As of December 2015, the public sector banks had 7,686 wilful defaulters, which accounted for Rs 66,000 crore of outstanding loans.[iv] The Standing Committee of Finance, in February 2016, observed that 21% of the total NPAs of banks were from wilful defaulters. It recommended that the names of top 30 wilful defaulters of every bank be made public. It noted that making such information publicly available would act as a deterrent for others.

Asset Reconstruction Companies (ARCs): ARCs purchase stressed assets from banks, and try to recover them. The ARCs buy NPAs from banks at a discount and try to recover the money. The Standing Committee observed that the prolonged slowdown in the economy had made it difficult for ARCs to absorb NPAs. Therefore, it recommended that the RBI should allow banks to absorb their written-off assets in a staggered manner. This would help them in gradually restoring their balance sheets to normal health.

Improved recovery: The process of recovering outstanding loans is time consuming. This includes time taken to resolve insolvency, which is a situation where a borrower is unable to repay his outstanding debt. The inability to resolve insolvency is one of the factors that impacts NPAS, the credit market, and affects the flow of money in the country.[v] As of 2015, it took over four years to resolve insolvency in India. This was higher than other countries such as the UK (1 year) and USA (1.5 years). The Insolvency and Bankruptcy Code seeks to address this situation. The Code, which was passed by Lok Sabha on May 5, 2016, is currently pending in Rajya Sabha. It provides a 180-day period to resolve insolvency (which includes change in repayment schedule of loans to recover outstanding loans.) If insolvency is not resolved within this time period, the company will go in for liquidation of its assets, and the creditors will be repaid from these sale proceeds.

[i] ‘Non-Performing Assets of Financial Institutions’, 27th Report of the Department-related Standing Committee on Finance, http://164.100.47.134/lsscommittee/Finance/16_Finance_27.pdf. [ii] Bankruptcy Law Reforms Committee, November 2015, http://finmin.nic.in/reports/BLRCReportVol1_04112015.pdf. [iii] Volume 2, Economic Survey 2015-16, http://indiabudget.nic.in/es2015-16/echapter-vol2.pdf. [iv] Starred Question No. 17, Rajya Sabha, Answered on April 26, Ministry of Finance. [v] Report of the Bankruptcy Law Reforms Committee, Ministry of Finance, November 2015, http://finmin.nic.in/reports/BLRCReportVol1_04112015.pdf. *Source: ‘Non-Performing Assets of Financial Institutions’, 27th Report of the Department-related Standing Committee on Finance, http://164.100.47.134/lsscommittee/Finance/16_Finance_27.pdf; PRS.