Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

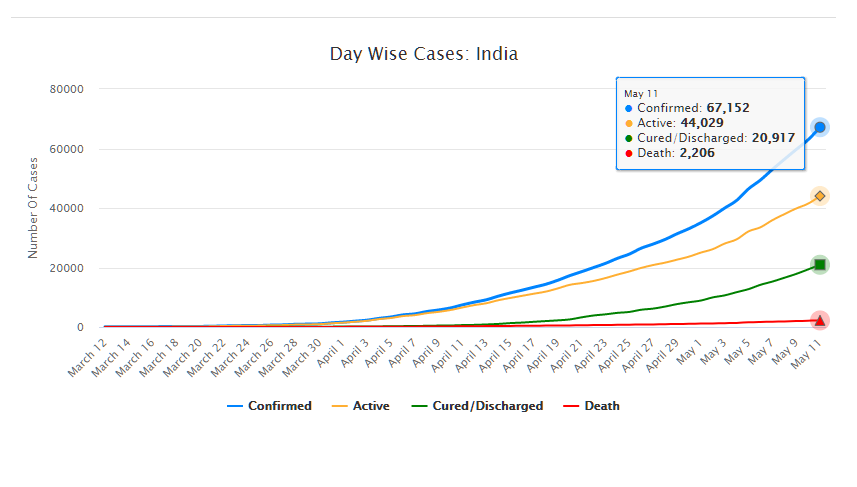

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

These are challenging times for chit fund operators. A scam involving the Saradha group allegedly conning customers under the guise of a chit fund, has raised serious questions for the industry. With a reported 10,000 chit funds in the country handling over Rs 30,000 crore annually, chit fund proponents maintain that these funds are an important financial tool. The scam has also sparked responses from both the centre and states: the Finance Ministry, Ministry of Corporate Affairs and SEBI have all promised to act and the West Bengal Assembly has passed The West Bengal Protection of Interest of Depositors in Financial Establishments Bill, 2013, with Odisha and Haryana considering similar legislation. What is a chit fund? A chit fund is a type of saving scheme where a specified number of subscribers contribute payments in instalment over a defined period. Each subscriber is entitled to a prize amount determined by lot, auction or tender depending on the nature of the chit fund. Typically the prize amount is the entire pool of contribution minus a discount which is redistributed to subscribers as a dividend. For example, consider an auction-type chit fund with 50 subscribers contributing Rs 100 every month. The monthly pool is Rs 5,000 and this is auctioned out every month. The winning bid, say Rs 1000, would be the discount and be distributed among the subscribers. The winning bidder would then receive Rs 4,000 (Rs 5,000 – 1,000) while the rest of subscribers would receive Rs 20 (1000/50). Winners cannot enter the auction again and will be liable for the monthly subscription as the process is repeated for the duration of the scheme. The company managing the chit fund (foreman) would retain a commission from the prize amount every month. Collectively, the subscribers to a chit fund are referred to as a chit group and a chit fund company may run many such groups. What are the laws governing chit funds? Classifying them as contracts, the Supreme Court has read chit funds as being part of the Concurrent List of the Indian Constitution; hence both the centre and state can frame legislation regarding chit funds. States like Tamil Nadu, Andhra Pradesh and Kerala had enacted legislation (e.g The Kerala Chitties Act, 1975 and The Tamil Nadu Chit Funds Act, 1961) for regulating chit funds. Chit Funds Act, 1982 In 1982, the Ministry of Finance enacted the Chit Funds Act to regulate the sector. Under the Act, the central government can choose to notify the Act in different states on different dates; if the Act is notified in a state, then the state act would be repealed[i]. States are responsible for notifying rules and have the power to exempt certain chit funds from the provisions of the Act. Last year the central government, notified the Act in Arunachal Pradesh, Gujarat, Haryana, Kerala and Nagaland. Under the Act, all chit funds require previous sanction from the state government. The capital requirement for establishing chit funds is Rs 1 lakh and at least 10% of profits should be transferred to a reserve fund. The amount of discount (i.e. the bid) is capped at 40% of the total chit fund value. States may appoint a Registrar who would be responsible for regulation, inspection and dispute settlement in the sector. Any grievances over decisions made by the Registrar can be subject to appeals directed to the state government. Chit fund managers are required to deposit the entire value of the chit fund (can be done in 50% cash and 50% bank guarantee) with the Registrar for the duration of the chit cycle. Prize Chits and Money Circulation Schemes (Banning) Act, 1978 The Prize Chits and Money Circulation Schemes (Banning) Act, 1978 defines and prohibits any illegal chit fund schemes (e.g. schemes where auction winners are not liable to future payments). Again, the responsibility for enforcing the provisions of this Act lies with the state government. Reports suggest that the government is discussing amendments to this Bill in the wake of the chit fund scam. West Bengal Protection of Interest of Depositors in Financial Establishments Bill, 2013 Last month the West Bengal Assembly passed the West Bengal Protection of Interest of Depositors in Financial Establishments Bill, 2013. This was a direct response to the chit fund scam in West Bengal. While not regulating chit funds directly, the Act regulates and restricts financial establishments to curb any unscrupulous activity with regards to deposits. Chit funds are specifically included under the definition of deposits. The state government will appoint a competent authority to conduct investigations. What is the role of RBI and SEBI? The Reserve Bank of India (RBI) is the regulator for banks and other non banking financial companies (NBFCs) but does not regulate the chit fund business. While chit funds accept deposits, the term ‘deposit’ as defined under the Reserve Bank of India Act, 1934 does not include subscriptions to chits. However the RBI can provide guidance to state governments on regulatory aspects like creating rules or exempting certain chit funds. As the regulator of the securities market, SEBI regulates collective investment schemes. But the SEBI Act, 1992 specifically excludes chit funds from their definition of collective investment schemes. In the recent case with Sarada Group, the SEBI investigation discovered that Sarada were, in effect, operating a collective investment scheme without SEBI’s approval.

[i] The central act repeals the Andhra Pradesh Chit Funds Act, 1971; the Kerala Chitties Act, 1975, the Maharashtra Chit Funds Act, 1974’, the Tamil Nadu Chit Funds Act, 1961 (applicable in Chandiragh and Delhi), the Uttar Pradesh Chit Funds Act, 1975, Goa, Daman and Diu Chit Funds Act, 1973 and Pondicheery Funds Act, 1966.