Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

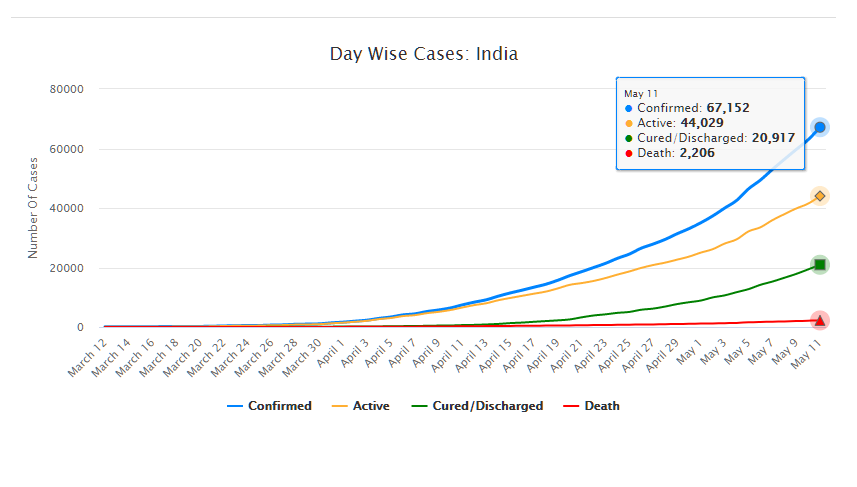

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

Authored by Vishnu Padmanabhan and Priya Soman The Budget speech may have already been scrutinised and the numbers analysed but the Budget process is far from complete. The Constitution requires expenditure from the government’s Consolidated Fund of India to be approved by the Lok Sabha (the Rajya Sabha does not vote, but can suggest changes). After the Finance Minister presents the Union Budget, Parliament holds a general discussion followed by a detailed discussion and vote on Demands for Grants. In the general discussion, the House discusses the Budget as a whole but no motions can be moved and no voting takes place. In the 15th Lok Sabha, the average time spent during the Budget Session on general discussion has been 13 hours 20 minutes so far. Following the general discussion, Parliament breaks for recess while Demands for Grants – the projected expenditure by different ministries - are examined by the relevant Standing Committees of Parliament. This year Parliament is scheduled to break for a month from March 22nd to April 22nd. After the break, the Standing Committees table their reports; the grants are discussed in detail and voted on. Last year, the total time spent on the Union Budget, on both general and detailed discussion was around 32 hours (or 18% of total time in the session), largely in line with the average time spent over the last 10 years (33 hours, 20% of total time). A unique feature of Indian democracy is the separate presentation and discussion for the Railway Budget. Including the Railway Budget the overall time spent on budget discussion last year was around 55 hours (30% of total time in the session).

Note: All data from Budget sessions; data from 2004 and 2009 include interim budget sessions. Source: Lok Sabha Resume of Work, PRS

Note: All data from Budget sessions; data from 2004 and 2009 include interim budget sessions. Source: Lok Sabha Resume of Work, PRS

During the detailed discussion, MPs can call for ‘cut motions’ to reduce the amounts of demands for grants made by a Ministry. This motion can be tabled in three ways: (i) ‘the amount of the demand be reduced to Re.1/’ signifying disapproval of the policies of that ministry; (ii) ‘the amount of the demand be reduced by a specified amount’, an economy cut signifying a disapproval of the amount spent by the ministry and (iii) ‘the amount of the demand be reduced by Rs.100/-', a token cut airing a specific grievance within the policy of the government. However in practice almost all demands for grants are clubbed and voted together (a process called guillotining). In 2012, 92% of demands for grants were guillotined. The grants for Ministries of Commerce and Industry, Health and Family Welfare, Home Affairs and Urban Development were the only grants taken up for discussion. Over the last 10 years, 85% of demands for grants have been voted for without discussion. The most frequently discussed demand for grants come from the Ministry of Home Affairs (discussed in 6 of the last 10 sessions) and the Ministry of Rural Development (5 times). Demand for grants for Defence, the largest spending Ministry, has only been voted after discussion once in the last 10 years.

Source: Lok Sabha Resume of Work, Union Budget documents, PRS

Source: Lok Sabha Resume of Work, Union Budget documents, PRS

If the government needs to spend any additional money, it can introduce Supplementary Demands for Grants during the year. However if after the financial year government spending on a service exceeds the amount granted, then an Excess Demand for Grant has to be introduced and passed in the following year. The Budget process concludes with the introduction and passage of the Appropriation Bill authorising the government to spend money from the Consolidated Fund of India. In addition, a Finance Bill, containing the taxation proposals of the government is considered and passed by the Lok Sabha after the Demands for Grants have been voted upon.