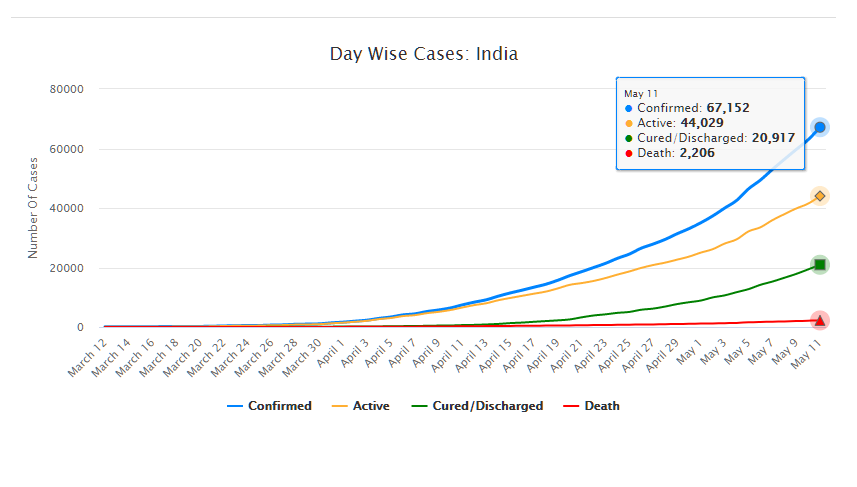

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.

The issue of the General Anti Avoidance Rule (GAAR) has dominated the news recently and there are fears that GAAR will discourage foreign investment in India. However, tax avoidance can hinder public finance objectives and it is in this context GAAR was introduced in this year’s Budget. Last week, the Finance Minister pushed back the implementation of GAAR by a year. What is GAAR? GAAR was first introduced in the Direct Taxes Code Bill 2010. The original proposal gave the Commissioner of Income Tax the authority to declare any arrangement or transaction by a taxpayer as ‘impermissible’ if he believed the main purpose of the arrangement was to obtain a tax benefit. The 2012-13 Finance Bill (Bill), that was passed by Parliament yesterday, defines ‘impermissible avoidance arrangements’ as an arrangement that satisfies one of four tests. Under these tests, an agreement would be an ‘impermissible avoidance arrangement’ if it (i) creates rights and obligations not normally created between parties dealing at arm’s length, (ii) results in misuse or abuse of provisions of tax laws, (iii) is carried out in a way not normally employed for bona fide purpose or (iv) lacks commercial substance. As per the Bill, arrangements which lack commercial substance could involve round trip financing, an accommodating party and elements that have the effect of offsetting or cancelling each other. A transaction that disguises the value, location, source, ownership or control of funds would also be deemed to lack commercial substance. The Bill as introduced also presumed that obtaining a tax benefit was the main purpose of an arrangement unless the taxpayer could prove otherwise. Why? GAAR was introduced to address tax avoidance and ensure that those in different tax brackets are taxed the correct amount. In many instances of tax avoidance, arrangements may take place with the sole intention of gaining a tax advantage while complying with the law. This is when the doctrine of ‘substance over form’ may apply. ‘Substance over form’ is where real intention of parties and the purpose of an arrangement is taken into account rather than just the nomenclature of the arrangement. Many countries, like Canada and South Africa, have codified the doctrine of ‘substance over form’ through a GAAR – type ruling. Issues with GAAR A common criticism of GAAR is that it provides discretion and authority to the tax administration which can be misused. The Standing Committee responded to GAAR in their report on the Direct Taxes Code Bill in March, 2012. They suggested that the provisions should ensure that taxpayers entering genuinely valid arrangements are not harassed. They recommended that the onus should be on tax authorities, not the taxpayer, to prove tax avoidance. In addition, the committee suggested an independent body to act as the approving panel to ensure impartiality. They also recommended that the assessing officer be designated in the code to reduce harassment and unwarranted litigation. GAAR Amendments On May 8, 2012 the Finance Minister amended the GAAR provisions following the Standing Committee’s recommendations. The main change was to delay the implementation of GAAR by a year to “provide more time to both taxpayers and the tax administration to address all related issues”. GAAR will now apply on income earned in 2013-14 and thereafter. In addition, the Finance Minister removed the burden upon the taxpayer to prove that the main purpose of an alleged impermissible arrangement was not to obtain tax benefit. These amendments were approved with the passing of the Bill. In his speech, the Finance Minister stated that a Committee had also been formed under the Chairmanship of the Director General of Income Tax. The Committee will suggest rules, guidelines and safeguards for implementation of GAAR. The Committee is expected to submit its recommendations by May 31, 2012 after holding discussions with various stakeholders in the debate.