"No one can ignore Odisha's demand. It deserves special category status. It is a genuine right," said Odisha Chief Minister, Naveen Patnaik, earlier this month. The Odisha State assembly has passed a resolution requesting special category status and their demands follow Bihar's recent claim for special category status. The concept of a special category state was first introduced in 1969 when the 5th Finance Commission sought to provide certain disadvantaged states with preferential treatment in the form of central assistance and tax breaks. Initially three states Assam, Nagaland and Jammu & Kashmir were granted special status but since then eight more have been included (Arunachal Pradesh, Himachal Pradesh, Manipur, Meghalaya, Mizoram, Sikkim, Tripura and Uttarakhand). The rationale for special status is that certain states, because of inherent features, have a low resource base and cannot mobilize resources for development. Some of the features required for special status are: (i) hilly and difficult terrain; (ii) low population density or sizeable share of tribal population; (iii) strategic location along borders with neighbouring countries; (iv) economic and infrastructural backwardness; and (v) non-viable nature of state finances. [1. Lok Sabha unstarred question no. 667, 27 Feb, 2013, Ministry of Planning] The decision to grant special category status lies with the National Development Council, composed of the Prime Minster, Union Ministers, Chief Ministers and members of the Planning Commission, who guide and review the work of the Planning Commission. In India, resources can be transferred from the centre to states in many ways (see figure 1). The Finance Commission and the Planning Commission are the two institutions responsible for centre-state financial relations.

Figure 1: Centre-state transfers (Source: Finance Commission, Planning Commission, Budget documents, PRS)

Figure 1: Centre-state transfers (Source: Finance Commission, Planning Commission, Budget documents, PRS)

Planning Commission and Special Category The Planning Commission allocates funds to states through central assistance for state plans. Central assistance can be broadly split into three components: Normal Central Assistance (NCA), Additional Central Assistance (ACA) and Special Central Assistance. NCA, the main assistance for state plans, is split to favour special category states: the 11 states get 30% of the total assistance while the other states share the remaining 70%. The nature of the assistance also varies for special category states; NCA is split into 90% grants and 10% loans for special category states, while the ratio between grants and loans is 30:70 for other states. For allocation among special category states, there are no explicit criteria for distribution and funds are allocated on the basis of the state's plan size and previous plan expenditures. Allocation between non special category states is determined by the Gadgil Mukherjee formula which gives weight to population (60%), per capita income (25%), fiscal performance (7.5%) and special problems (7.5%). However, as a proportion of total centre-state transfers NCA typically accounts for a relatively small portion (around 5% of total transfers in 2011-12). Special category states also receive specific assistance addressing features like hill areas, tribal sub-plans and border areas. Beyond additional plan resources, special category states can enjoy concessions in excise and customs duties, income tax rates and corporate tax rates as determined by the government. The Planning Commission also allocates funds for ACA (assistance for externally aided projects and other specific project) and funds for Centrally Sponsored Schemes (CSS). State-wise allocation of both ACA and CSS funds are prescribed by the centre. The Finance Commission Planning Commission allocations can be important for states, especially for the functioning of certain schemes, but the most significant centre-state transfer is the distribution of central tax revenues among states. The Finance Commission decides the actual distribution and the current Finance Commission have set aside 32.5% of central tax revenue for states. In 2011-12, this amounted to Rs 2.5 lakh crore (57% of total transfers), making it the largest transfer from the centre to states. In addition, the Finance Commission recommends the principles governing non-plan grants and loans to states. Examples of grants would include funds for disaster relief, maintenance of roads and other state-specific requests. Among states, the distribution of tax revenue and grants is determined through a formula accounting for population (25%), area (10%), fiscal capacity (47.5%) and fiscal discipline (17.5%). Unlike the Planning Commission, the Finance Commission does not distinguish between special and non special category states in its allocation.

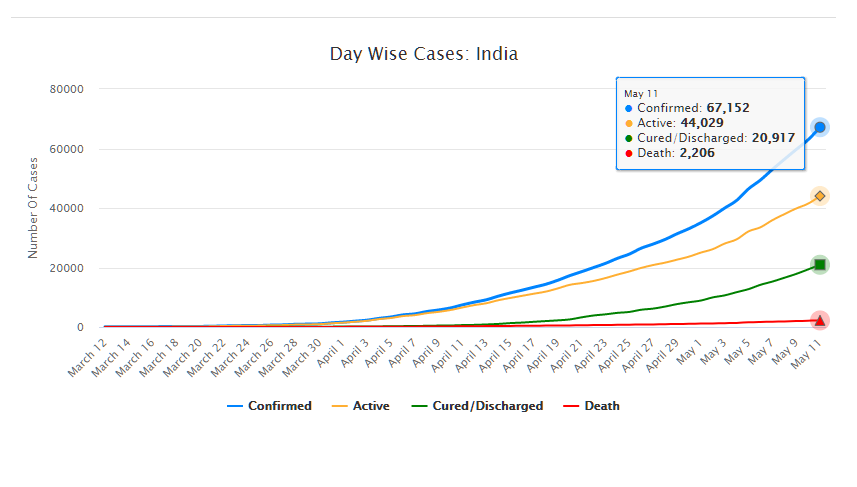

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.