Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

All companies are currently governed by the Companies Act, 1956. The Act has been amended 24 times since then. Three committees were formed in the last ten years, chaired by Justice V B Eradi (2001), Naresh Chandra (2002) and J J Irani (2005) to look into various aspects of corporate governance and company law. The Companies Bill, 2009 incorporates some of these recommendations. Main features The major themes of the Bill are as follows: It moves a number of issues that are currently specified in the Act (and its schedules) to the Rules; this change will make the law more flexible, as changes can be made through government notification, and would not require an amendment bill in Parliament. On a number of issues, the Bill moves the onus of oversight towards shareholders and away from the government. It also requires a super-majority of 75 percent shareholder votes for certain decisions. The powers of creditors have been enhanced in cases where a company is in financial distress. It has new provisions regarding independent directors and auditors in order to strengthen corporate governance. Finally, the bill increases penalties, and provides for special courts. Types of companies The Bill provides for six types of companies. Public companies need to have at least seven shareholders, and private companies between two and 50 shareholders. Charitable companies should have at least one shareholder, may have only certain specified objectives, and may not distribute dividend. Three new types of companies have been defined, which have less stringent provisions. These are one-person companies, small companies (private companies with capital less than Rs 50 million and turnover below Rs 200 million), and dormant companies (formed for future projects, or no operations for two years). Corporate Governance The Bill defines the duties of directors and norms for composition of boards. The number of directors is capped at 12. At least one director should be resident in India for at least 183 days in a calendar year and at least a third of the board should consist of independent directors. The Bill also sets guidelines for auditors. Certain related persons such as creditors, debtors, shareholders and guarantors cannot be appointed as auditors. Certain services such as book-keeping, internal audit and management services may not be undertaken by the auditors. Removal of an auditor before completion of term requires approval of 75 percent of the shareholders. Adjudication The Bill provides for a National Company Law Tribunal (NCLT) to adjudicate disputes between companies and their stakeholders. It also establishes an Appellate Tribunal. The NCLT may ask the government to investigate the working of a company on an application made by 100 shareholders or those who hold 10 percent of the voting power. Arrangements All arrangements such as mergers, takeovers, debt split, share splits and reduction in share capital must be approved by 75 percent of creditors or shareholders, and sanctioned by the NCLT. Standing Committee’s Recommendations The Parliamentary Standing Committee on Finance has submitted its report, and suggested several significant amendments. Corporate governance Substantive matters covered in various corporate governance guidelines should be contained in the Bill. These include: separation of offices of Chairman and Chief Executive Officer; limiting the number of companies in which an individual may become director; attributes for independent directors; appointment of auditors. Delegated legislation The Committee noted that the Bill provided excessive scope for delegated legislation. Several substantive provisions were left for rule-making and the Ministry was asked to reconsider provisions made for excessive delegated legislation. The Ministry has agreed to make some changes to include the following provisions in the Act: the definition of small companies; the manner of subscribing names to the Memorandum of Association; the format of Memorandum of Association to be prescribed in the Schedule; the manner of conducting Extraordinary General Meetings; documents to be filed with the Registrar of Companies. The Committee recommended that provisions relating to independent directors in the Bill should be distinguished from other directors. There should be a clear expression of their mode of appointment, qualifications, extent of independence from management, roles, responsibilities, and liabilities. The Committee also recommended that the appointment process of independent Directors should be made independent of the company’s management. This should be done by constituting a panel to be maintained by the Ministry of Corporate Affairs, out of which companies can choose their requirement of independent directors. Investor protection The Ministry, in response to the Committee’s concerns for ensuring protection of small investors and minority shareholders, indicated new proposals. These include: enhanced disclosure requirements at the time of incorporation; shareholder’s associations/groups enabled to take legal action in case of any fraudulent action by the company; directors of a company which has defaulted in payment of interest to depositors to be disqualified for future appointment as directors. The Ministry also made some suggestions on protection of minority shareholders/small investors, which the Committee accepted, including the source of promoter’s contribution to be disclosed in the Prospectus; stricter rules for bigger and solvent companies on acceptance of deposits from the public; return to be filed with Registrar in case of promoters/top ten shareholders stake changing beyond a limit. Corporate Delinquency Recommendations include: subsidiary companies not to have further subsidiaries; main objects for raising public offer should be mentioned on the first page of the prospectus; tenure of independent director should be provided in law; the office of the Chairman and the Managing Director/CEO should be separated. The Committee emphasised that the procedural defaults should be viewed in a different perspective from fraudulent practices. Shareholder democracy The Committee recommended that the system of proxy voting should be discontinued. It also stated that the quorum for company meetings should be higher than the proposed five members, and should be increased to a reasonable percentage. Foreign companies The Bill requires foreign companies having a place of business in India and with Indian shareholding to comply with certain provisions in the proposed Bill. The Committee observed that the Bill does not clearly explain the applicability of the Bill to foreign companies incorporated outside India with a place of business in India. It recommended that all such foreign companies should be brought within the ambit of the chapter dealing with foreign companies. Next steps The report of the Standing Committee indicates that the Ministry has accepted many of its recommendations. It is likely that the government will take up the Bill for consideration and passing during the winter session, which starts on 9th November. This article was published in PRAGATI on November 1, 2010

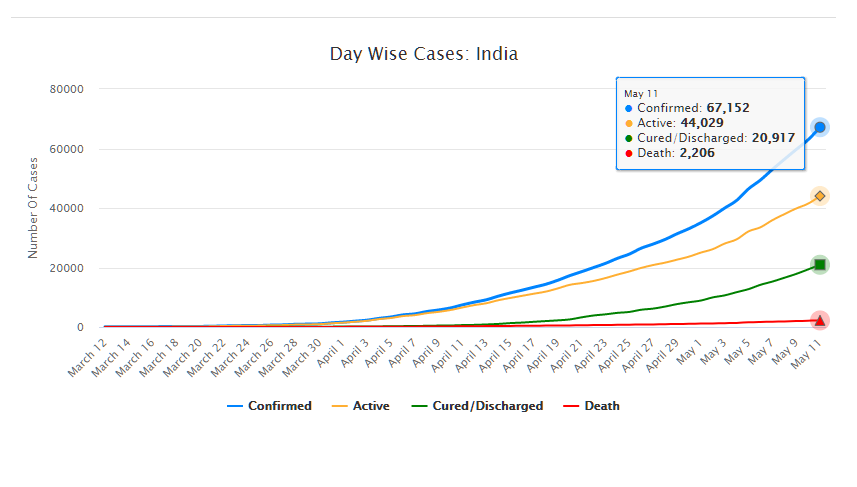

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.