Applications for the LAMP Fellowship 2026-27 are closed. Shortlisted candidates will be asked to take an online test on January 4, 2026.

The Finance Bill, 2017 is being discussed in Lok Sabha today. Generally, the Finance Bill is passed as a Money Bill since it gives effect to tax changes proposed in the Union Budget. A Money Bill is defined in Article 110 of the Constitution as one which only contains provisions related to taxation, borrowings by the government, or expenditure from Consolidated Fund of India. A Money Bill only needs the approval of Lok Sabha, and is sent to Rajya Sabha for its recommendations. It is deemed to be passed by Rajya Sabha if it does not pass the Bill within 14 calendar days.

In addition to tax changes, the Finance Bill, 2017 proposes to amend several laws such the Securities Exchange Board of India Act, 1992 and the Payment and Settlements Act, 2007 to make structural changes such as creating a payments regulator and changing the composition of the Securities Appellate Tribunal. This week, some amendments to the Finance Bill were circulated. We discuss the provisions of the Bill, and the proposed amendments.

Certain Tribunals to be replaced

Amendments to the Finance Bill seek to replace certain Tribunals and transfer their functions to existing Tribunals. The rationale behind replacing these Tribunals is unclear. For example, the Telecom Disputes Settlement and Appellate Tribunal (TDSAT) will replace the Airports Economic Regulatory Authority Appellate Tribunal. It is unclear if TDSAT, which primarily deals with issues related to telecom disputes, will have the expertise to adjudicate matters related to the pricing of airport services. Similarly, it is unclear if the National Company Law Appellate Tribunal, which will replace the Competition Appellate Tribunal, will have the expertise to deal with matters related to anti-competitive practices.

Terms of service of Tribunal members to be determined by central government

The amendments propose that the central government may make rules to provide for the terms of service including appointments, term of office, salaries and allowances, and removal for Chairpersons and other members of Tribunals, Appellate Tribunals and other authorities. The amendments also cap the age of retirement for Chairpersons and Vice-Chairpersons. Currently, these terms are specified in the laws establishing these Tribunals.

One may argue that allowing the government to determine the appointment, reappointment and removal of members could affect the independent functioning of the Tribunals. There could be conflict of interest if the government were to be a litigant before a Tribunal as well as determine the appointment of its members and presiding officers.

The Supreme Court in 2014, while examining a case related to the National Tax Tribunal, had held that Appellate Tribunals have similar powers and functions as that of High Courts, and hence matters related to their members’ appointment and reappointment must be free from executive involvement.[i] The list of Tribunals under this amendment includes several Tribunals before which the central government could be a party to disputes, such as those related to income tax, railways, administrative matters, and the armed forces Tribunal.

Note that a Bill to establish uniform conditions of service for the chairpersons and members of some Tribunals has been pending in Parliament since 2014.

Inclusion of technical members in the Securities Appellate Tribunal

The composition of the Securities Appellate Tribunal established under the SEBI Act is being changed by the Finance Bill. Currently, the Tribunal consists of a Presiding Officer and two other members appointed by the central government. This composition is to be changed to: a Presiding Officer, and a number of judicial and technical members, as notified by the central government.

Creation of a Payments Regulatory Board

Recently, the Ratan Watal Committee under the Finance Ministry had recommended creating a statutory Payments Regulatory Board to oversee the payments systems in light of increase in digital payments. The Finance Bill, 2017 seeks to give effect to this recommendation by creating a Payments Regulatory Board chaired by the RBI Governor and including members nominated by the central government. This Board will replace the existing Board for Regulation and Supervision of Payment and Settlement Systems.

Political funding

The Finance Bill, 2017 proposes to make changes related to how donations may be made to political parties, and maintaining the anonymity of donors.

Currently, for donations below Rs 20,000, details of donors do not have to be disclosed by political parties. Further, there are no restrictions on the amount of cash donations that may be received by political parties from a person. The Finance Bill has proposed to set this limit at Rs 2,000. The Bill also introduces a new mode of donating to political parties, i.e. through electoral bonds. These bonds will be issued by banks, which may be bought through cheque or electronic means. The only difference between cheque payment (above Rs 20,000) and electoral bonds may be that the identity of the donor will be anonymous in the case of electoral bonds.

Regarding donations by companies to political parties, the proposed amendments to the Finance Bill remove the: (i) existing limit of contributions that a company may make to political parties which currently is 7.5% of net profit of the last three financial years, (ii) requirement of a company to disclose the name of the parties to which a contribution has been made. In addition, the Bill also proposes that contributions to parties will have to be made only through a cheque, bank draft, electronic means, or any other instrument notified by the central government.

Aadhaar mandatory for PAN and Income Tax

Amendments to the Finance Bill, 2017 make it mandatory for every person to quote their Aadhaar number after July 1, 2017 when: (i) applying for a Permanent Account Number (PAN), or (ii) filing their Income Tax returns. Persons who do not have an Aadhaar will be required to quote their Aadhaar enrolment number indicating that an application to obtain Aadhaar has been filed.

Every person holding a PAN on July 1, 2017 will be required to provide the authorities with his Aadhaar number by a date and in a manner notified by the central government. Failure to provide this number would result in the PAN being invalidated.

The Finance Bill, 2017 is making structural changes to some laws. Parliamentary committees allow for a forum for detailed scrutiny, deliberations and public consultation on proposed laws. The opportunity to build rigour into the law-making process is lost if such legislative changes are not examined by committees

[i] Madras Bar Association vs. Union of India, Transfer Case No. 150 of 2006, Supreme Court of India, September 25, 2014 (para 89).

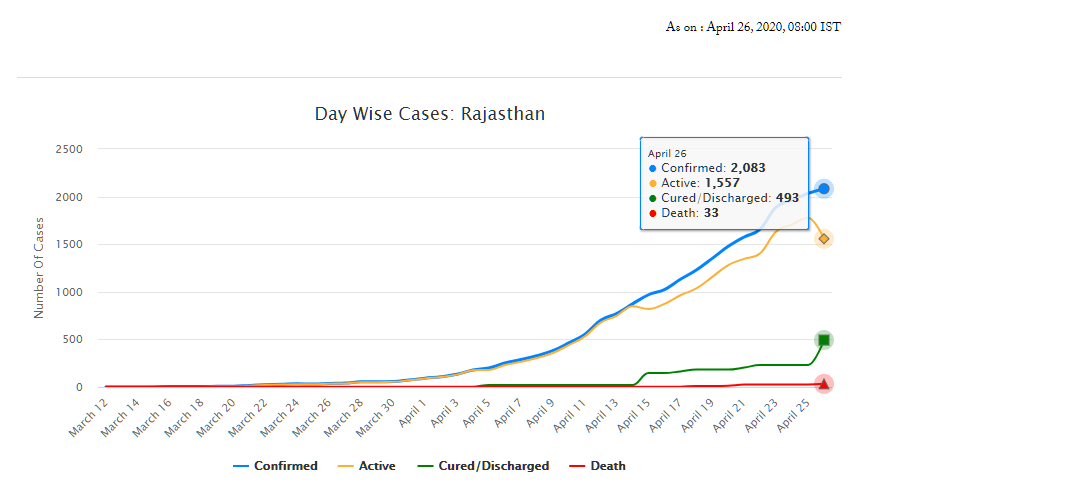

As of April 26, Rajasthan has 2,083 confirmed cases of COVID-19 (fifth highest in the country), of which 493 have recovered and 33 have died. On March 18, the Rajasthan government had declared a state-wide curfew till March 31, to check the spread of the disease. A nation-wide lockdown has also been in place since March 25 and is currently, extended up to May 3. The state has announced several policy decisions to prevent the spread of the virus and provide relief for those affected by it. This blog summarises the key policy measures taken by the Government of Rajasthan in response to the COVID-19 pandemic.

Early measures for containment

Between late January and early February, Rajasthan Government’s measures were aimed towards identification, screening and testing, and constant monitoring of passenger arrivals from China. Instructions were also issued to district health officials for various prevention, treatment, & control related activities, such as (i) mandatory 28-day home isolation for all travellers from China, (ii) running awareness campaigns, and (iii) ensuring adequate supplies of Personal Protection Equipments (PPEs). Some of the other measures, taken prior to the state-wide lockdown, are summarised below:

Administrative measures

The government announced the formation of Rapid Response Teams (RRTs), at the medical college-level and at district-level on March 3 and 5, respectively.

The District Collector was appointed as the Nodal Officer for all COVID-19 containment activities. Control Rooms were to be opened at all Sub-divisional offices. The concerned officers were also directed to strengthen information dissemination mechanisms and tackle the menace of fake news.

Directives were issued on March 11 to rural health workers/officials to report for duty on Gazetted holidays. Further, government departments were shut down between March 22 and March 31. Only essential departments such as Health Services were allowed to function on a rotation basis at 50% capacity and special / emergency leaves were permitted.

Travel and Movement

Air travellers were to undergo 14-day home isolation and were also required to provide an undertaking for the same. Besides, those violating the mandated isolation/quarantine were liable to be punished under Section. 188 of the Indian Penal Code. Penalties are imposed under this section on persons for the willful violation of orders that have been duly passed by a public servant.

All institutions and establishments, such as (i) educational institutions, theatres, and gyms, (ii) anganwadis, (iii) bars, discos, libraries, restaurants etc, (iv) museums and tourist places, were directed to be shut down till March 31.

The daily Jan Sunwai at the Chief Minister’s residence was cancelled until further notice. Various government offices were directed to shut down and exams of schools and colleges were postponed.

On March 24, the government issued a state-wide ban on the movement of private vehicles till March 31.

Health Measures

Advisories regarding prevention and control measures were issued to: (i) District Collectors, regarding sample collection and transportation, hotels, and preparedness of hospitals, (ii) Police department, to stop using breath analysers, (iii) Private hospitals, regarding preparedness and monitoring activities, and (iv) Temple trusts, to disinfect their premises with chemicals.

The government issued Standard Operating Procedures for conducting mock drills in emergency response handling of COVID-19 cases. Training and capacity building measures were also initiated for (i) Railways, Army personnel etc and (ii) ASHA workers, through video conferencing.

A model micro-plan for containing local transmission of COVID was released. Key features of the plan include: (i) identification and mapping of affected areas, (ii) activities for prevention control, surveillance, and contact tracing, (iii) human resource management, including roles and responsibilities, (iv) various infrastructural and logistical support, such as hospitals, labs etc, and (v) communication and data management.

Resource Management: Private hospitals and medical colleges were instructed to reserve 25 % of beds for COVID-19 patients. They were also instructed to utilise faculty from the departments of Preventive and Social Medicine to conduct health education and awareness activities.

Over 6000 Students of nursing schools were employed in assisting the health department to conduct screening activities being conducted at public places, railways stations, bus stands etc.

Further, the government issued guidelines to ensure the rational use of PPEs.

Welfare Measures

The government announced financial assistance, in the form of encouragement grants, to health professionals engaged in treating COVID-19 patients.

Steps were also taken by the government to ensure speedy disbursal of pensions for February and March.

The government also initiated the replacement of the biometric authentication with an OTP process for distribution of ration via the Public Distribution System (PDS).

During the lockdown

State-wide curfew announced on March 18 has been followed by a nation-wide lockdown between March 25 and May 3. However, certain relaxations have been recommended by the state government from April 21 onwards. Some of the key measures undertaken during the lockdown period are:

Administrative Measures

Advisory groups and task forces were set up on – (i) COVID-19 prevention, (ii) Health and Economy, and (iii) Higher education. These groups will provide advice on the way forward for (i) prevention and containment activities, (ii) post-lockdown strategies and strategies to revive the economy, and (iii) to address the challenges facing the higher education sector respectively.

Services of retiring medical and paramedical professionals retiring between March and August have been extended till September 2020.

Essential Goods and Services

A Drug Supply Control Room was set up at the Rajasthan Pharmacy Council. This is to ensure uninterrupted supply of medicines during the lockdown and will also assist in facilitating home delivery of medicines.

The government permitted Fair Price Shops to sell products such as masalas, sanitisers, and hygiene products, in addition to food grains.

Village service cooperatives were declared as secondary markets to facilitate farmers to sell their produce near their own fields/villages during the lockdown.

A Whatsapp helpline was also set up for complaints regarding hoarding, black marketing, and overpricing.

Travel and Movement

Once lockdown was in place, the government issued instructions to identify, screen, and categorise people from other states who have travelled to Rajasthan. They were to be categorised into: (i) people displaying symptoms to be put in isolation wards, (ii) people over 60 years of age with symptoms and co-morbidities to be put in quarantine centres, and (iii) asymptomatic people to be home quarantined.

On March 28, the government announced the availability of buses to transport people during the lockdown. Further, stranded students in Kota were allowed to return to their respective states.

On April 2, a portal and a helpline were launched to help stranded foreign tourists and NRIs.

On April 11, an e-pass facility was launched for movement of people and vehicles.

Health Measures

To identify COVID-19 patients, district officials were instructed to monitor people with ARI/URI/Pneumonia or other breathing difficulties coming into hospital OPDs. Pharmacists were also instructed to not issue medicines for cold/cough without prescriptions.

A mobile app – Raj COVID Info – was developed by the government for tracking of quarantined people. Quarantined persons are required to send their selfie clicks at regular intervals, failing which a notification would be sent by the app. The app also provides a lot of information on COVID-19, such as the number of cases, and press releases by the government.

Due to the lockdown, people had restricted access to hospitals and treatment. Thus, instructions were issued to utilise Mobile Medical Vans for treatment/screening and also as mobile OPDs.

On April 20, a detailed action plan for prevention and control of COVID-19 was released. The report recommended: (i) preparation of a containment plan, (ii) formation of RRTs, (iii) testing protocols, (iv) setting up of control room and helpline, (v) designated quarantine centres and COVID-19 hospitals, (vi) roles and responsibilities, and (vii) other logistics.

Welfare Measures

The government issued instructions to make medicines available free of cost to senior citizens and other patients with chronic illnesses through the Chief Minister’s Free Medicine Scheme.

Rs 60 crore was allotted to Panchayati Raj Institutions to purchase PPEs and for other prevention activities.

A one-time cash transfer of Rs 1000 to over 15 lakh construction workers was announced. Similar cash transfer of Rs 1000 was announced for poor people who were deprived of livelihood during the lockdown, particularly those people with no social security benefits. Eligible families would be selected through the Aadhaar database. Further, an additional cash transfer of Rs 1500 to needy eligible families from different categories was announced.

The state also announced an aid of Rs 50 lakh to the families of frontline workers who lose their lives due to COVID-19.

To maintain social distancing, the government will conduct a door-to-door distribution of ration to select beneficiaries in rural areas of the state. The government also announced the distribution of free wheat for April, May, and June, under the National Food Security Act, 2013. Ration will also be distributed to stranded migrant families from Pakistan, living in the state.

The government announced free tractor & farming equipment on rent in tie-up with farming equipment manufacturers to assist economically weak small & marginal farmers.

Other Measures

Education: Project SMILE was launched to connect students and teachers online during the lockdown. Study material would be sent through specially formed Whatsapp groups. For each subject, 30-40 minute content videos have been prepared by the Education Department.

Industry: On April 18, new guidelines were issued for industries and enterprises to resume operations from April 20 onwards. Industries located in rural areas or export units / SEZs in municipal areas where accommodation facilities for workers are present, are allowed to function. Factories have been permitted to increase the working hours from 8 hours to 12 hours per day, to reduce the requirement of workers in factories. This exemption has been allowed for the next three months for factories operating at 60% to 65% of manpower capacity.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.