The Financial Resolution and Deposit Insurance Bill, 2017 was introduced in Lok Sabha during Monsoon Session 2017. The Bill is currently being examined by a Joint Committee of the two Houses of Parliament. It seeks to establish a Resolution Corporation which will monitor the risk faced by financial firms such as banks and insurance companies, and resolve them in case of failure. For FAQs explaining the regulatory framework under the Bill, please see here.

Over the last few days, there has been some discussion around provisions of the Bill which allow for cancellation or writing down of liabilities of a financial firm (known as bail-in).[1],[2] There are concerns that these provisions may put depositors in an unfavourable position in case a bank fails. In this context, we explain the bail-in process below.

What is bail-in?

The Bill specifies various tools to resolve a failing financial firm which include transferring its assets and liabilities, merging it with another firm, or liquidating it. One of these methods allows for a financial firm on the verge of failure to be rescued by internally restructuring its debt. This method is known as bail-in.

Bail-in differs from a bail-out which involves funds being infused by external sources to resolve a firm. This includes a failing firm being rescued by the government.

How does it work?

Under bail-in, the Resolution Corporation can internally restructure the firm’s debt by: (i) cancelling liabilities that the firm owes to its creditors, or (ii) converting its liabilities into any other instrument (e.g., converting debt into equity), among others.[3]

Bail-in may be used in cases where it is necessary to continue the services of the firm, but the option of selling it is not feasible.[4] This method allows for losses to be absorbed and consequently enables the firm to carry on business for a reasonable time period while maintaining market confidence.3 The Bill allows the Resolution Corporation to either resolve a firm by only using bail-in, or use bail-in as part of a larger resolution scheme in combination with other resolution methods like a merger or acquisition.

Do the current laws in India allow for bail-in? What happens to bank deposits in case of failure?

Current laws governing resolution of financial firms do not contain provisions for a bail in. If a bank fails, it may either be merged with another bank or liquidated.

In case of bank deposits, amounts up to one lakh rupees are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC). In the absence of the bank having sufficient resources to repay deposits above this amount, depositors will lose their money. The DICGC Act, 1961 originally insured deposits up to Rs 1,500 and permitted the DICGC to increase this amount with the approval of the central government. The current insured amount of one lakh rupees was fixed in May 1993.[5] The Bill has a similar provision which allows the Resolution Corporation to set the insured amount in consultation with the RBI.

Does the Bill specify safeguards for creditors, including depositors?

The Bill specifies that the power of the Corporation while using bail-in to resolve a firm will be limited. There are certain safeguards which seek to protect creditors and ensure continuity of critical functions of the firm.

When resolving a firm through bail-in, the Corporation will have to ensure that none of the creditors (including bank depositors) receive less than what they would have been entitled to receive if the firm was to be liquidated.[6],[7]

Further, the Bill allows a liability to be cancelled or converted under bail-in only if the creditor has given his consent to do so in the contract governing such debt. The terms and conditions of bank deposits will determine whether the bail-in clause can be applied to them.

Do other countries contain similar provisions?

After the global financial crisis in 2008, several countries such as the US and those across Europe developed specialised resolution capabilities. This was aimed at preventing another crisis and sought to strengthen mechanisms for monitoring and resolving sick financial firms.

The Financial Stability Board, an international body comprising G20 countries (including India), recommended that countries should allow resolution of firms by bail-in under their jurisdiction. The European Union also issued a directive proposing a structure for member countries to follow while framing their respective resolution laws. This directive suggested that countries should include bail-in among their resolution tools. Countries such as UK and Germany have provided for bail-in under their laws. However, this method has rarely been used.7,[8] One of the rare instances was in 2013, when bail-in was used to resolve a bank in Cyprus.

———————————————–

[1] ‘Modi government’s FRDI bill may take away all your hard-earned money’, India Today, December 5, 2017, http://indiatoday.intoday.in/story/frdi-bill-banking-reforms-modi-government-india-parliament/1/1103422.html.

[2] ‘Bail-in doubts — on financial resolution legislation’, The Hindu, December 5, 2017, http://www.thehindu.com/opinion/editorial/bail-in-doubts/article21261606.ece.

[3] Section 52, The Financial Resolution and Deposit Insurance Bill, 2017.

[4] Report of the Committee to Draft Code on Resolution of Financial Firms, September 2016, http://www.prsindia.org/uploads/media/Financial%20Resolution%20Bill,%202017/FRDI%20Bill%20Drafting%20Committee%20Report.pdf.

[5] The Deposit Insurance and Credit Guarantee Corporation Act, 1961, https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/dicgc_act.pdf. s

[6] Section 55, The Financial Resolution and Deposit Insurance Bill, 2017.

[7] The Bank of England’s approach to resolution, October 2014, Bank of England.

[8] Recovery and resolution, BaFin, Federal Financial Supervisory Authority of Germany, https://www.bafin.de/EN/Aufsicht/BankenFinanzdienstleister/Massnahmen/SanierungAbwicklung/sanierung_abwicklung_artikel_en.html.

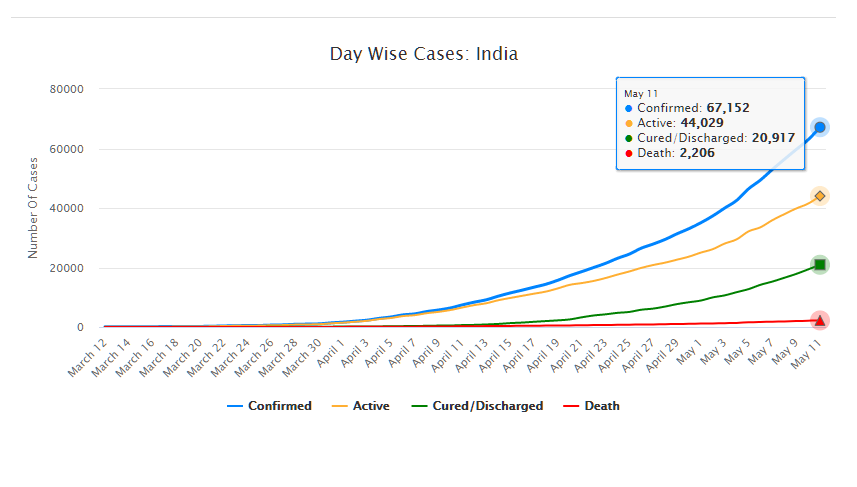

As of May 11, 2020, there are 67,152 confirmed cases of COVID-19 in India. Since May 4, 24,619 new cases have been registered. Out of the confirmed cases so far, 20,917 patients have been cured/discharged and 2,206 have died. As the spread of COVID-19 has increased across the country, the central government has continued to announce several policy decisions to contain the spread, and support citizens and businesses who are being affected by the pandemic. In this blog post, we summarise some of the key measures taken by the central government in this regard between May 4 and May 11, 2020.

Source: Ministry of Health and Family Welfare; PRS.

Industry

Relaxation of labour laws in some states

The Gujarat, Himachal Pradesh, Rajasthan, Haryana, and Uttarakhand governments have passed notifications to increase maximum weekly work hours from 48 hours to 72 hours and daily work hours from 9 hours to 12 hours for certain factories. This was done to combat the shortage of labour caused by the lockdown. Further, some state governments stated that longer shifts would ensure a fewer number of workers in factories so as to allow for social distancing.

Madhya Pradesh has promulgated the Madhya Pradesh Labour Laws (Amendment) Ordinance, 2020. The Ordinance exempts establishments with less than 100 workers from adhering to the Madhya Pradesh Industrial Employment (Standing Orders) Act, 1961, which regulates the conditions of employment of workers. Further, it allows the state government to exempt any establishment or class of establishments from the Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982, which provides for the constitution of a welfare fund for labour.

The Uttar Pradesh government has published a draft Ordinance which exempts all factories and establishments engaged in manufacturing processes from all labour laws for a period of three years. Certain conditions will continue to apply with regard to payment of wages, safety, compensation and work hours, amongst others. However, labour laws providing for social security, industrial dispute resolution, trade unions, strikes, amongst others, will not apply under the Ordinance.

Financial aid

Central government signs an agreement with Asian Infrastructure Investment Bank for COVID-19 support

The central government and Asian Infrastructure Investment Bank (AIIB) signed a 500 million dollar agreement for the COVID-19 Emergency Response and Health Systems Preparedness Project. The project aims to help India respond to the COVID-19 pandemic and strengthen India’s public health system to manage future disease outbreaks. The project is being financed by the World Bank and AIIB in the amount of 1.5 billion dollars, of which one billion dollars is being provided by World Bank and 500 million dollars is being provided by AIIB. This financial support will be available to all states and union territories and will be used to address the needs of at-risk populations, medical personnel, and creating medical and testing facilities, amongst others. The project will be implemented by the National Health Mission, the National Center for Disease Control, and the Indian Council of Medical Research, under the Ministry of Health and Family Welfare.

Travel

Restarting of passenger travel by railways

Indian Railways plans to restart passenger trains from May 12 onwards. It will begin with 15 pairs of trains which will run from New Delhi station connecting Dibrugarh, Agartala, Howrah, Patna, Bilaspur, Ranchi, Bhubaneswar, Secunderabad, Bengaluru, Chennai, Thiruvananthapuram, Madgaon, Mumbai Central, Ahmedabad and Jammu Tawi. Booking for reservation in these trains will start at 4 pm on May 11. Thereafter, Indian Railways plans to start more services on new routes.

Return of Indians stranded abroad

The central government will facilitate the return of Indian nationals stranded abroad in a phased manner beginning on May 7. The travel will be arranged by aircraft and naval ships. The stranded Indians utilising the service will be required to pay for it. Medical screening of the passengers will be done before the flight. On reaching India, passengers will be required to download the Aarogya Setu app. Further, they will be quarantined by the concerned state government in either a hospital or a quarantine institution for 14 days on a payment basis. After quarantine, passengers will be tested for COVID-19 and further action will be taken based on the results.

For more information on the spread of COVID-19 and the central and state government response to the pandemic, please see here.