The year 2021 began with an improvement in the economic outlook for the fiscal year 2020-21. December GST collections increased by 12 percent over the same month in 2019; the government has estimated a contraction of 7.7 percent in 2020-21 GDP, better than the initial projections after lockdown. The 2021-22 union and state budgets will naturally be based on a strong GDP growth estimate due to a lower level of GDP in 2020-21 as the base.

However, it will be crucial to see if this year, or how soon, government finances recover to the pre-pandemic levels. There will be more clarity on this trajectory after the 15th Finance Commission report is presented, which may also provide a roadmap for recovery or fiscal consolidation during the next five years. This article discusses some near-term challenges for states in the context of the state of their finances in 2020-21.

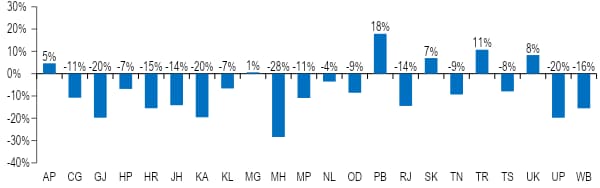

An analysis of the revenue receipts of 22 states during the period Apr-Nov 2020 shows a 13 percent decline in revenue over the same period in 2019-20. States have been guaranteed a 14 percent growth in their GST revenue till 2022, which would have at least taken care of the loss in GST revenue.

However, they did not receive this benefit in 2020-21 as the Centre is providing GST compensation as loans to states, and not grants. Because of the economic impact of COVID-19, the Centre could not collect sufficient funds through the cess levied to pay compensation to states. It proposed two options to states, one of which required them to borrow Rs 1.1 lakh crore in 2020-21 in lieu of GST compensation grants. These loans taken by states will be later repaid by the Centre. All states chose this option, which also allowed them to borrow an additional 0.5 percent of GSDP on their own.

Figure 1: Change in states’ revenue receipts during the period Apr-Nov 2020 over the same period in 2019

Note: Data for NL, PB, and WB is till October and for HP and MH till September – their figures till November may see some improvement if revenue of these states is higher in the later months of 2020. The growth in revenue of some states may be due to higher central grants.

Sources: CAG; PRS.

Facing revenue loss during the lockdown, more than 20 states increased their tax or duty rates on petrol, diesel, and/ or alcohol. While these sources contribute to about 15 percent of states’ revenue, typically, these taxes are increased when states want to increase their revenue.

This is due to limited flexibility of states on nearly 65 percent of their revenue – 46 percent of the revenue comes from the Centre and another 19 percent depends on state GST, which is decided by the GST Council. Note that states’ taxation powers may further decrease in the future as the Council is constitutionally required to recommend a date for levying GST on petroleum products.

In light of the limited flexibility in increasing revenue, states have relied more on borrowing in 2020-21 to maintain their expenditure. Till January 1, 2021, net market borrowings of states during 2020-21 was at Rs 4.6 lakh crore, almost the same as that during the full year 2019-20. Adding the loans in lieu of GST compensation would further increase their borrowings to Rs 5.2 lakh crore as of date. States can either use these additional borrowings to fill the gap created by revenue loss, to maintain overall expenditure, or adjust their spending as per the revised estimates.

Typically, states need to restrict their net borrowing or fiscal deficit within the limit of 3 percent of GSDP. However, this year, states have been able to increase their borrowings as the Centre has allowed them a fiscal deficit of up to 5 percent of GSDP for 2020-21. The 5 percent of GSDP limit allowed states an unconditional fiscal deficit of up to 3.5 percent of GSDP. Another 0.5 percent of GSDP was made available to all states after they chose the option of loans in lieu of GST compensation grants.

The remaining 1 percent of GSDP will be available after the implementation of reforms in four areas (0.25 percent of GSDP for each reform). These are:

(i) one nation one ration card (implemented by 10 states so far)

(ii) ease of doing business (by 8 states)

(iii) urban local body/ utility (by 4 states), and

(iv) power distribution (no state has implemented this reform).

In October 2020, RBI projected the aggregate fiscal deficit of states in 2020-21 to increase to around 4 percent of GDP. This will further increase states’ debt, leading to higher expenditure on interest payments going forward. Note that even before COVID-19, the outstanding debt of states at the end of 2020-21 was estimated to be at the highest level since 2007-08 (26.6 percent of GDP).

Table 1: Fiscal deficit approved for states for the year 2020-21 and net market borrowings (Rs crore)

| State | Unconditional (4% of GSDP) ^ | Conditional borrowing allowed so far(out of 1% of GSDP) * | Net market borrowingsApr-Oct 2020 | Increase in borrowingsover Apr-Oct 2019 |

| Andhra Pradesh | 40,408 | 7,575 | 32,584 | 89% |

| Arunachal Pradesh | 1,142 | 0 | 428 | -9% |

| Assam | 14,954 | 0 | 5,300 | 43% |

| Bihar | 25,846 | 0 | 15,000 | 17% |

| Chhattisgarh | 14,334 | 0 | 3,000 | 50% |

| Goa | 3,570 | 223 | 1,400 | 75% |

| Gujarat | 69,632 | 4,351 | 16,823 | 36% |

| Haryana | 34,346 | 2,147 | 17,900 | 42% |

| Himachal Pradesh | 7,014 | 0 | 1,200 | -40% |

| Jharkhand | 14,120 | 0 | 2,100 | - |

| Karnataka | 72,144 | 9,018 | 35,000 | 235% |

| Kerala | 36,174 | 4,522 | 15,930 | 46% |

| Madhya Pradesh | 37,966 | 7,119 | 14,000 | 215% |

| Maharashtra | 1,23,152 | 0 | 52,450 | 320% |

| Manipur | 1,206 | 75 | 700 | 14% |

| Meghalaya | 1,550 | 0 | 1,000 | 342% |

| Mizoram | 1,054 | 0 | 342 | 33% |

| Nagaland | 1,256 | 0 | 550 | - |

| Odisha | 22,864 | 1,429 | 3,000 | 0% |

| Punjab | 24,262 | 0 | 9,945 | 14% |

| Rajasthan | 43,698 | 2,731 | 23,868 | 45% |

| Sikkim | 1,246 | 0 | 615 | 36% |

| Tamil Nadu | 77,014 | 4,813 | 46,194 | 97% |

| Telangana | 40,136 | 7,524 | 22,627 | 64% |

| Tripura | 2,376 | 149 | 600 | -34% |

| Uttar Pradesh | 77,622 | 4,851 | 8,791 | -48% |

| Uttarakhand | 11,238 | 0 | 3,000 | 200% |

| West Bengal | 54,298 | 0 | 16,500 | 73% |

| Total | 8,54,622 | 56,526 | 3,50,847 | 78% |

Note: *Conditional borrowing approval as on January 15, 2021. ^Unconditional borrowing level is based on the approval given by the Centre in March 2020, so may get revised before the end of the year. There may be minor differences in figures due to rounding off.

Sources: Unstarred Question No. 206, September 14, 2020, Lok Sabha; Ministry of Finance; RBI; PRS.

With regard to expenditure, accounts of these 22 states for Apr-Nov 2020 show a 4 percent decrease in spending as compared to the same period the previous year. The decline is disproportionately higher for capital expenditure (26 percent). This is particularly concerning as more than 60 percent of the government’s total capital expenditure depends on the states. A similar outcome was seen in 2019-20 due to the economic slowdown when there was negligible growth in states’ revenue. Due to revenue shortfall, states cut spending and the overall expenditure grew at a much lower pace of 4 percent.

As nearly half of the revenue expenditure consists of committed spending, such as salaries, pension, and interest, capital expenditure bore the brunt – it declined by 9 percent in 2019-20 to around Rs 4 lakh crore.

The National Infrastructure Pipeline of Rs 111 lakh crore proposed by the central government in April 2020 estimates 25 percent of the funds to come from state budgets. This is equivalent to an expenditure of nearly Rs 28 lakh crore during 2019-20 to 2024-25, or an average of Rs 4.6 lakh crore per year, which may not be achievable in view of the declining trend in capital expenditure. To incentivize states to do capital investment in 2020-21, the Centre is providing 50-year interest-free loans of total Rs 12,000 crore to states (equivalent to 2 percent of their planned capital outlay for 2020-21).

COVID-19 has also highlighted certain other challenges for state finances. On average, states spend around 5 percent of their budget on health, much lower than the 8 percent target recommended in the National Health Policy, 2017. Further risks have emerged from the persistent poor financial situation of state-owned power distribution companies. States will guarantee loans of Rs 90,000 crore (0.46 percent of GDP) for these companies, which can translate into debt if there is a risk of default.

With the GST compensation guarantee ending in 2022, the GST Council will likely meet again this year to discuss the way forward. Even before COVID-19, some states were highly dependent on compensation for their revenue, e.g., in 2019-20, Punjab estimated 20 percent of its revenue to come from compensation; in Delhi, this was 16 percent. As compensation ends, such states may have to find alternate tax and non-tax sources of revenue to bridge this gap to maintain the same 14 percent-level of growth.

The author is Senior Analyst at PRS Legislative Research. Views are personal